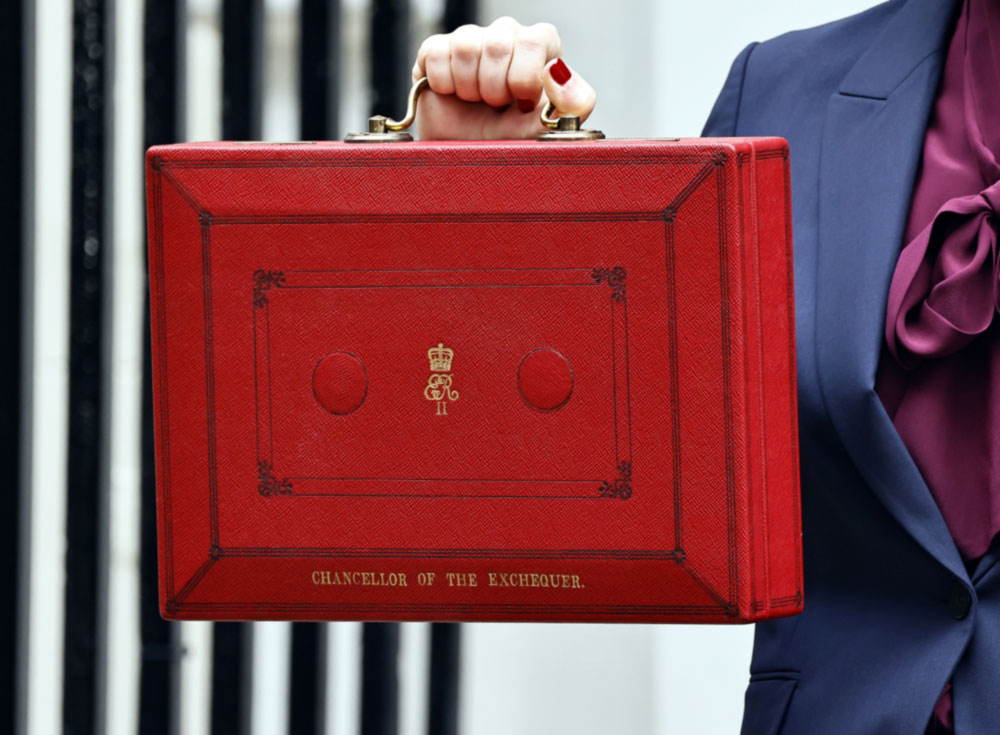

The Autumn 2025 Budget included several changes that may affect households, and businesses. We’ve highlighted the key points below, with more detail to follow in our December newsletter. If you have any concerns about how the updates might impact you, please do get in touch.

Our top 3 key planning takeaways are:

- Venture Capital Trust (VCT)* – act now to make use of the 30% tax relief before this reduces to 20% from April 2026.

- Review your ISA funding strategy, considering the changes coming.

- Evaluate your inheritance tax planning, with the nil rate allowances frozen even further.

Taxes

- Income tax rates will not change, and the annual allowance will remain frozen at £12,570 to 2030-31, an extension of three more years since last year’s Autumn Statement. This will raise a further £8bn in tax revenue.

- The inheritance tax nil rate band will also be frozen for an extra year to 2030-31.

- There will be an additional 2% tax applied to dividends, property and savings income from 2026 and 2027. This will raise £2.1bn in tax revenue.

- Capital Gains Tax relief on disposals to employee ownership trusts will be reduced from 100% relief to 50% relief. This will raise £900m in tax revenue.

- From April 2028, a council tax surcharge will be applied to properties worth over £2m. The per annum surcharges will be £2,500 for properties of £2m-£2.5m; £3,500 for properties of £2.5m-£3.5m; £5,000 for properties of £3.5m-£5m; and £7,500 per annum for properties over £5m. This will raise £400m in tax revenue.

Pensions and savings

- The £20,000 cash ISA limit will be changed to require a minimum of £8,000 to be invested in stocks and shares, from April 2027. This will effectively reduce the cash ISA limit to £12,000.

- Cash ISA savers who are over 65, however, will be allowed to continue with the existing £20,000 limit.

- Lifetime ISAs will be consulted on and could be replaced or removed.

- Interest from 2026 dividends and 2027 savings on investments will be hit by the 2% tax increase mentioned above.

- From 2029, salary-sacrificed pension contributions will be subject to NI where they are over a cap of £2,000 per annum. This will raise a further £4.7bn.

- The full basic state pension will rise by £440 a year, and more for people on the full new state pension.

EIS and VCT (Venture Capital Trust)

- The Income Tax relief that can be claimed by an individual investing in VCT to reduce to 20% from the current rate of 30%. Conclusion: act now before April to get 30% relief while it lasts!

- Enterprise Investment Schemes and Seed Enterprise Investment Schemes will continue.

Living costs

- Fuel duty cut kept for another year.

- The two-child benefit cap within Universal Credit will be removed from April 2026.

- A new vehicle excise duty will be introduced for electric vehicles.

- The Soft Drinks Industry Levy or ‘sugar tax’ will be expanded to include milk drinks such as milkshakes and lattes.

- The previous government’s Energy Company Obligation system will be axed which Reeves claims will save £150 per annum off average energy bills.

- Alcohol duty will increase in line with inflation.

Businesses

- The Writing Down Allowance rate for corporation tax will be reduced from 18% to 14% from April 2026. This will raise £1.5bn in tax revenue.

- There will be relief for UK stock market listings, with a three-year exemption from stamp duty. There will be a consultation on attracting more entrepreneurs.

- There will be a 40% first-year allowance to permit businesses to write off more of their upfront investment costs.

- The Energy Profits Levy on oil and gas companies will continue through to 2030.

- Corporation tax will stay capped at 25%.

- The minimum wage for over-21s will increase by 50p per hour from April, to £12.71, a rise of 4.1%. Workers aged 18 to 20 will get a bigger increase of 8.5%, to £10.85 an hour, and 16 and 17-year-olds will get a 6% increase to £8 an hour.

Economy

- Rachel Reeves made much of the OBR’s improved forecast of 1.5% growth for 2025. However, the longer-term picture is less positive. In 2026, the economy is now expected to expand by 1.4%, below a previous forecast of 1.9%. For 2027, GDP is estimated to expand by 1.6% against March’s estimate of 1.8%. In 2028, GDP is forecast to rise by 1.5%. against 1.7% in March. In 2029, the economy will expand by 1.5%, not 1.8% as thought in March.

- The OBR estimates the measures outlined by the chancellor will increase headroom against its borrowing to £22 billion in 2029 to 2030, £12 billion more than it forecast in March.

- A further £4.9bn in savings will be found and re-invested in services through cuts made to 2031, such as the removal of police and crime commissioners.

- There is always a little choppiness in financial markets during a budget, but this is unlikely to last given there were no plans announced to significantly increase borrowing.

Over the coming days, we’ll be taking a close look at what the Chancellor has announced and what it means for our clients; and we’ll share our conclusions with you in our December newsletter – so keep an eye on your inbox. Please note that all our commentary on the 2025 Autumn Budget is for information only and does not constitute advice. Please do contact your personal adviser if you wish to talk through what the changes might mean for you in detail.

The information contained within this article is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change. The value of your investments can go down as well as up, so you could get back less than you invested.

*VCTs are high risk investments and may not be appropriate for your financial situation, please speak with your adviser. There may be no market for the shares should you wish to dispose of them. You may lose your capital.